Plan / Grow / Enjoy / Give

"Someone's sitting in the shade today because someone planted a tree a long time ago"

Warren Buffett

We view wealth management as the balanced combination of professional investment management, and personalised, ongoing financial planning.

Professional investment management

"Are my investments working hard enough?"

It's the one consistent question we're asked whichever stage of life our clients are at and it's why our core service is Professional investment management. We create and manage tailor-made investment portfolios based on your individual goals. These high-quality portfolios change with your circumstances, risk profile and goals and allow us to partner with you over the long term and provide ongoing holistic advice.

Financial planning

Whether you're just starting out in your career or business, growing your family, watching your children find their own path, retiring, or looking to transfer your wealth, each stage of life brings its own financial challenges. At Keep Wealth we'll commit to understand, care and guide you through all these decisions so that each stage can also bring financial rewards, as well as providing you with more of those scarce resources... time and peace of mind.

As your trusted advisor we will partner with you, helping you make the best decisions to accomplish your goals. This includes (but is not limited to) advice on budgeting, asset structuring, tax management, risk management, insurance, estate planning, generational wealth education and charitable giving. As your circumstances change, we stay with you every step of the way to ensure you remain on the right path.

Levels of service

You have your own unique circumstances and objectives so we tailor our offering to fit your needs. Please speak to us to see which of our services will suit you best.

External professionals

In guiding you we will work with our network of professionals (or those chosen by you) to ensure your wishes are met. We do not accept any referral fees from our preferred service network as our professional relationships are based simply on how well they care for our clients.

Fees

Fees are fixed each year with your agreement. These fees include professional investment management, ongoing financial planning and regular review meetings. We re-engage with you each year to ensure you are getting value for money.

What next?

If you would like to learn more about our services we’d be happy to meet to discuss your options. Any initial consultation will be complimentary.

If you choose to join us we will provide a detailed engagement letter outlining what you can expect. We will take time to fully understand your vision for your life and how it fits into your circumstances and objectives, as well as how you view and experience risk.

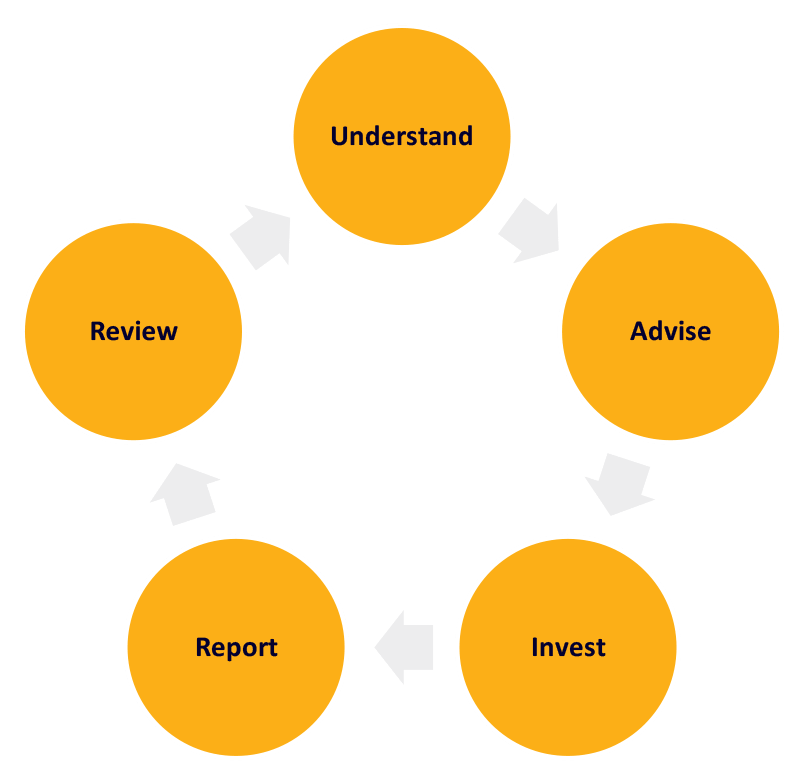

Only then do we provide you with an integrated strategy and collaborate with you on a plan to optimise it. Our conversations and support are ongoing through every stage of the advice cycle.