We Give the Power of Superannuation Back to You

It’s fair to say that the decision to manage your own superannuation should not be taken lightly or without advice. While a self-managed super fund (SMSF) may be an effective mechanism for growing your wealth, managing your own investment decisions does come with a set of restrictions, rules, and risks.

If you have or are considering a self-managed super fund for wealth management, the team at Keep Wealth Partners can provide flexible, independent, and personalised SMSF advice you can trust. With our team of independent financial advisors on your side, you can leverage all of the benefits of a self-managed super fund knowing you’re backed by financial planning professionals with decades of experience.

A self-managed super fund is a form of super that you and up to three other members – will be responsible for managing yourself. The financial and legal obligations of a self-managed super fund may seem daunting, but with SMSF advice from Keep Wealth Partners, making the most of your SMSF can be straightforward.

Not all funds are created equal and our SMSF advice can vary based on whether this tax structure is right for you through to recommending investment decisions that grow your superannuation fund and nurture your wealth.

Self-managed super funds are usually recommended for high-wealth individuals who have strong financial backing to support the fund to get the most advantage of the benefits of an SMSF. Ultimately, the choice to open a self-managed super fund and the investments decisions that are made must be actioned by the SMSF.

Our independent, certified financial advisers with a strong accounting background can help to ensure clients are correctly setting up and managing the SMSF fund. With experts on your side, you don’t need to worry about the logistics, and you can rest assured that your super is working for you.

At Keep Wealth Partners, our approach to SMSF advice is underpinned by the relationships that we build with our clients. By understanding your goals, motivations, and financial circumstances, we can position your SMSF to grow wealth now and into the future.

When you come to Keep Wealth Partners for SMSF advice, you can expect the following:

- A holistic and people-based approach to your financial future, rather than transactional-based advice. This ensures greater value and fewer expenses throughout the process.

- More than 20 years of financial services experience to help guide your SMSF investment decisions.

- A commission and conflict-free approach to financial services. We are wholly independent, and we rebate any commissions received.

- A flexible, future-focused approach. Our SMSF advice will evolve and change depending on your goals, your needs, the state of financial markets, and a range of other factors.

Simon, Andrew, and Brendan from Keep Wealth Partners take a hands-on approach in the establishment and ongoing management of your SMSF. You can expect an efficient, hassle-free and personalised process when you work with Keep Wealth Partners.

For SMSF advice and investment strategies, choose the team at Keep Wealth Partners. Call us today on 03 8610 6396 or contact us online.

Levels of service

You have your own unique circumstances and objectives so we tailor our offering to fit your needs. Please speak to us to see which of our services will suit you best.

External professionals

In guiding you we will work with our network of professionals (or those chosen by you) to ensure your wishes are met. We do not accept any referral fees from our preferred service network as our professional relationships are based simply on how well they care for our clients.

Fees

Fees are fixed each year with your agreement. These fees include professional investment management, ongoing financial planning and regular review meetings. We re-engage with you each year to ensure you are getting value for money.

What next?

If you would like to learn more about our services we’d be happy to meet to discuss your options. Any initial consultation will be complimentary.

If you choose to join us we will provide a detailed engagement letter outlining what you can expect. We will take time to fully understand your vision for your life and how it fits into your circumstances and objectives, as well as how you view and experience risk.

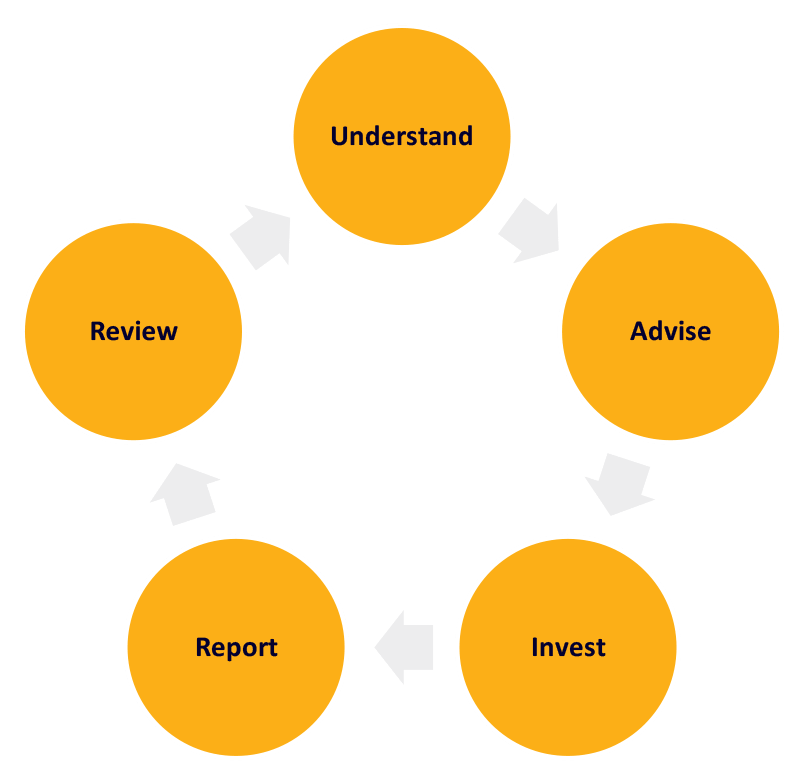

Only then do we provide you with an integrated strategy and collaborate with you on a plan to optimise it. Our conversations and support are ongoing through every stage of the advice cycle.